Sweetwater Title Loans provide a unique solution for quick cash, using vehicle titles as collateral, ideal for emergencies or unexpected expenses. Eligibility requires meeting lender criteria, including vehicle ownership and value assessments. Understanding interest rates, terms, and duration is key to securing the best rates, with longer durations often reducing monthly payments. Debt consolidation options may offer more affordable rates with good credit history.

“Uncover the power of Sweetwater title loans – a secure borrowing option offering potential benefits and advantages. This comprehensive guide navigates the basics, elucidating how these loans work and their unique selling points. We demystify the eligibility criteria, ensuring you understand the requirements before applying. Additionally, we provide valuable tips to help secure affordable rates, making your Sweetwater title loan journey smoother. By following these insights, borrowers can access desirable terms and conditions.”

- Understanding Sweetwater Title Loans: Basics and Benefits

- Eligibility Criteria: What You Need to Know Before Applying

- Securing the Best Rates: Tips for Affordable Loan Access

Understanding Sweetwater Title Loans: Basics and Benefits

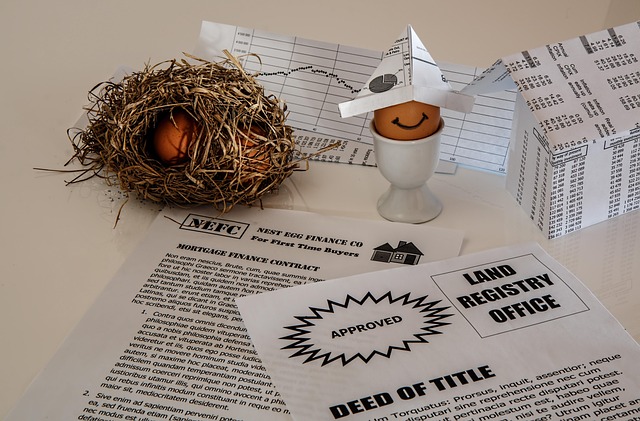

Sweetwater Title Loans are a financial solution that offers a unique approach to securing loans with the use of vehicle titles as collateral. This type of loan is designed for individuals who may need fast access to cash, especially when facing unexpected expenses or financial emergencies. By utilizing your vehicle’s equity, Sweetwater Title Loans provide an alternative to traditional banking options, catering to those who might not have excellent credit or require quicker turnaround times.

One of the key benefits is the simple and transparent process. Borrowers can apply for Fort Worth Loans by providing their vehicle information and title details. With quick approval, you could have the funds transferred into your account in no time. The loan terms are often more flexible compared to other short-term financing options, allowing borrowers to manage their repayments at their own pace while retaining ownership of their vehicles during the loan period. This makes Sweetwater Title Loans an attractive option for those seeking a hassle-free and efficient way to access funds with minimal stress.

Eligibility Criteria: What You Need to Know Before Applying

Before applying for Sweetwater title loans, understanding the eligibility criteria is essential. Lenders will consider various factors to determine your suitability for a loan. Primarily, they assess if you own a vehicle and its value. Sweetwater title loans are secured loans, so having clear Vehicle Ownership is a basic requirement. Lenders will evaluate the condition and make of your vehicle, among other details, to calculate its worth.

Beyond that, Loan Refinancing might be an option if you already have an existing loan and need cash. Lenders will look at your ability to repay, considering factors like income, employment history, and credit score (though not always a deciding factor). Each lender may have unique Loan Requirements, so it’s beneficial to research and compare before applying. Ensure you meet these criteria to increase your chances of securing an affordable Sweetwater title loan.

Securing the Best Rates: Tips for Affordable Loan Access

Securing the best rates for Sweetwater title loans can be a game-changer when it comes to managing your finances. The key lies in understanding that these loans are secured against the value of your vehicle, so maintaining good car condition and ensuring a clear title is paramount. When comparing San Antonio Loans, pay attention to interest rates and terms offered by various lenders. Opting for longer loan durations can often reduce monthly payments significantly. Additionally, shopping around for debt consolidation options might open doors to more affordable rates, especially if you have a strong credit history.

Meeting the loan requirements head-on is crucial. Lenders will assess your vehicle’s condition and its resale value, so keeping it well-maintained can boost your chances of securing better terms. Demonstrating responsible borrowing behavior by repaying other debts on time can also positively impact your interest rates. Remember, a little preparation and knowledge about the market can go a long way in accessing affordable Sweetwater title loans tailored to your needs, whether for debt consolidation or any other financial purpose.

Sweetwater title loans can be a viable option for those in need of quick cash. By understanding the basics, knowing the eligibility criteria, and utilizing tips to secure affordable rates, you can make an informed decision. Remember that while these loans offer benefits, they also come with risks, so always weigh your options carefully before applying.