Sweetwater title loans offer quick cash for unforeseen expenses using your vehicle as collateral, with flexible terms and lower interest rates than traditional personal loans. However, default can result in vehicle loss. Borrowers in Texas have legal protections, including clear terms, detailed information, and the right to cancel without penalty. Repayment options include early full repayment or extending the term, but defaulting may lead to repossession, legal issues, and additional fees, highlighting the need for careful planning and timely payments.

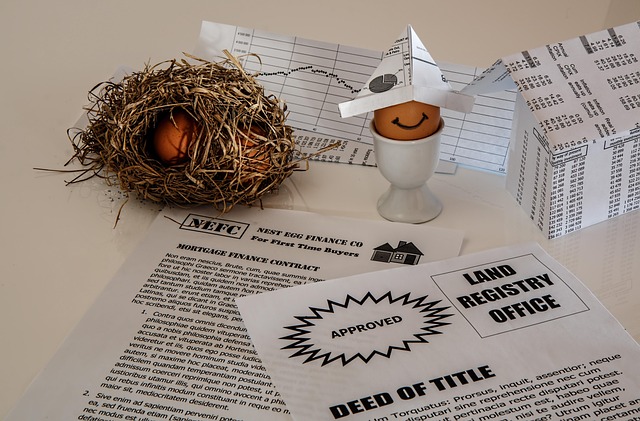

Navigating the complex landscape of financial options is a crucial step in making informed decisions. In the world of Sweetwater title loans, understanding both the benefits and inherent risks is essential. This article guides borrowers through the legal considerations surrounding these unique lending products, covering fundamentals like loan types, terms, and potential pitfalls. We explore the rights and protections afforded to borrowers, repayment flexibility, and the consequences of default, empowering folks to make savvy choices regarding Sweetwater title loans.

- Understanding Sweetwater Title Loans: Basics and Risks

- Legal Rights and Protections for Borrowers

- Repayment Options and Default Consequences

Understanding Sweetwater Title Loans: Basics and Risks

Sweetwater title loans are a type of secured lending where borrowers use their vehicle’s ownership as collateral to secure a loan. This option is often sought by individuals requiring quick access to cash, typically for unforeseen expenses or financial emergencies. The process involves a simple application, where lenders assess the value of the borrower’s vehicle and offer a loan amount based on that assessment. However, it’s crucial to understand both the benefits and risks associated with this type of borrowing.

One advantage is that sweetwater title loans often have more flexible terms and lower interest rates compared to traditional personal loans, especially for borrowers with less-than-perfect credit. The vehicle serves as security, which reduces the lender’s risk, potentially resulting in better loan conditions. However, the primary risk lies in the potential loss of Vehicle Ownership if the borrower defaults on repayments. A comprehensive understanding of the terms and conditions is essential, including repayment schedules, interest calculations, and any hidden fees to ensure borrowers are not left with a substantial debt or without their vehicle.

Legal Rights and Protections for Borrowers

When considering a Sweetwater title loan, borrowers should be aware of their legal rights and protections. These rights are designed to ensure that lenders adhere to fair and transparent practices, providing borrowers with clear terms and conditions. In Texas, including cities like San Antonio, lenders must comply with state laws that regulate title loans, offering borrowers a level of security and safeguard against predatory lending.

Understanding one’s rights is crucial for making informed decisions about borrowing. Borrowers are entitled to receive detailed information about the loan agreement, including interest rates, repayment schedules, and any associated fees. Furthermore, they have the right to cancel the loan within a specific timeframe without penalty, allowing them to change their minds or find alternative financing options if needed. Knowing these protections can empower borrowers to navigate the process with confidence, ensuring they exercise their rights during the loan eligibility assessment and throughout the payoff period.

Repayment Options and Default Consequences

When considering a Sweetwater title loan, borrowers should be aware of various repayment options available to them. These loans are typically structured around the retention of vehicle ownership, allowing borrowers to use their vehicles as collateral. Repayment can be made in full prior to the loan’s maturity date, offering peace of mind and potential savings on interest. Alternatively, borrowers can choose to extend the loan term through refinancings or partial payments, providing more flexibility but potentially incurring extended fees.

Defaulting on a Sweetwater title loan comes with significant consequences. In the event of non-payment, lenders may initiate repossession proceedings, revoking vehicle ownership rights. This process can lead to legal complications and additional financial burdens, including repossition costs and potential legal fees. Furthermore, late payments or missed installments can result in accrued interest and penalties, intensifying the overall cost of the loan. Understanding these repercussions underscores the importance of careful planning and timely repayment for those seeking fast cash through Sweetwater title loans.

When considering a Sweetwater title loan, understanding your legal rights and obligations is crucial. This article has provided insights into the basics, risks, rights, repayment options, and default consequences of such loans, empowering borrowers to make informed decisions. Remember that while these loans can offer quick access to cash, proper planning and knowledge of the legal framework are essential to avoid adverse outcomes.